Code violations often occur when a property is neglected or suffers damage from a disaster. Building codes protect the general welfare and safety of occupants. Failure to maintain a property leads to citations and costly fines.

A house that is not up to code is NOT impossible to sell. The big concern is if a buyer can obtain financing and insurance. Mortgage lenders often require issues to be resolved by the seller prior to closing. But even if a buyer closes on the house “as-is,” house insurance will be pricier.

Here are three options for selling a house with code violations.

Option 1: Make Repairs Before Listing

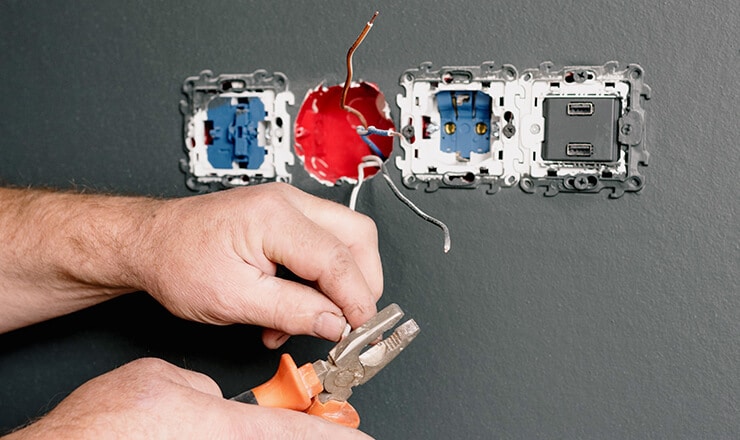

If you want the best possible price for your property, your best option might be to make repairs. It all depends on the scope of the problem. Simple violations are often inexpensive and do not take long to fix. Larger problems though, like plumbing or foundation, take more time and money. If neither your savings nor your timeline allow for repairs, you may want to look into other options.

You must also take into consideration the market condition. If buyers have property options, they can demand repairs or walk away from a sale.

Option 2: Lower the Price or Offer Credit

If you cannot afford to make repairs, but still want to list, you must disclose all code violations to buyers. You can offer them credit at closing or reduce your asking price. The difference will help the buyer cover repair costs.

Whether you can actually make a sale depends on the sort of violations. If they threaten safety and health, chances are a traditional buyer will not make an offer.

An inspection is required by most loan types. If you are not forthcoming with all issues, and a home inspector uncovers the truth, the buyer will walk away. However, if the inspector misses something, the house closes, and then later it’s discovered, legal action can be taken against you.

Option 3: Sell “As-Is” to a Cash Buyer

If your priority is to sell fast, without repairs, selling “as-is” to a cash buyer is your best option. It is difficult to find a traditional buyer who will pay cash for a problem property. Only real estate investors and house flippers find difficult houses attractive and will throw out offers to purchase.

At SolidOffers, we work with investor buyers who pay cash for properties in any condition. Most pay 70% of the market value AFTER repair value. They also pay 100% of closing costs and do not require traditional sale warranties or inspections. Even better: they let you pick the closing date, in several months, 15 days or less.